A strong grasp of donors’ motivations empowers nonprofits to increase donations, volunteer hours, advocacy actions, and more. The easiest way to develop this understanding is to simply ask your supporters through a process called nonprofit market research.

This guide will cover the essentials of nonprofit market research, including:

At DNL OmniMedia, we specialize in market research for nonprofits. That includes building a fundraising strategy, leveraging your CRM data, and more. We’ve seen firsthand the power of nonprofit market research—lean on our expertise in this guide! Let’s begin by covering the basics.

Market Research for Nonprofit Organizations: The Basics

What is a market analysis for nonprofit organizations?

Market analysis, also known as market research, is the process of collecting, analyzing, and interpreting information about target markets and customers.

For nonprofit organizations, in particular, this research is used to understand the priorities of their donors, volunteers, grant-making organizations, and so forth. With this understanding, organizations can more effectively communicate with and appeal to those supporters to be more successful when it comes to their fundraising and advocacy efforts.

Why do nonprofits use market research?

Many nonprofit organizations have at least a vague understanding of the perceptions, motivations, and attitudes of their audience— i.e. individuals give to a specific nonprofit because they support the nonprofit’s cause.

However, the nonprofit landscape is crowded; there are many worthy organizations competing for limited resources. For your organization to stand out from the crowd, you need a strong, fact-based understanding of what exactly inspires your supporters to give their time, money, and more.

Market research gives nonprofits this fact-based understanding. You can answer the following questions:

- How do donors really feel about your nonprofit?

- What motivated donors to make their first donation to your nonprofit?

- What would inspire them to make a second donation?

- How does your nonprofit stack up against competitors or like-minded organizations?

- Are volunteers and advocates satisfied with how you currently communicate with them?

- Do your messages resonate, or do they leave your audience confused or underwhelmed?

Your nonprofit can then use this information to inform future fundraising and outreach efforts, tailoring them to appeal to your unique audience. Rather than basing your campaigns on a “hunch,” you can base them on quantifiable data.

What insights can come from nonprofit research?

Market research can yield a number of useful insights, including:

- How to better engage with your current audience. When you understand what motivates your audience, you can handcraft engagement strategies that appeal to their unique interests. The more your audience enjoys your content, the more time and energy they’ll give to your organization.

- How to identify and attract a new stream of supporters. When you have a strong understanding of the types of individuals who tend to support your nonprofit, you also understand what a strong prospective supporter looks like. You can target your messaging to reach individuals with a high likelihood of supporting your organization and share communications to which they’ll be likely to respond positively.

- How to improve operational inefficiencies that are stopping your nonprofit from reaching its goals. Nonprofits operate with limited resources; an outreach approach that blindly attempts to reach as many people as possible with little analysis will quickly burn through those resources with sub-par success. Market research allows organizations to focus their efforts on only the most successful strategies, omitting those less likely to yield results.

While market research requires an investment of time and resources upfront, the long-term benefits can have wide-reaching implications across your organization’s overall efforts.

How to Conduct Nonprofit Market Research

As with any other strategic effort at your nonprofit, an organized approach from the start is crucial for success. There are effectively unlimited directions that your market research effort could turn; having a clear strategy in place ensures that you obtain the insights that you seek (rather than a significant amount of useless data).

Use the following steps to conduct market research with a strategic approach.

Step 1: Establish the objectives for your nonprofit market research.

Before you begin conducting research, first define what exactly your nonprofit wants to learn or achieve with the information you collect. This information— what you want to learn— is referred to as your objective.

Ask yourself the following questions to narrow down your research objectives:

- What are your goals as an organization, from both a mission-driven and operational perspective?

- What do you do really well? Where would you like to improve?

- What do you know about your current audience? What would you like to know?

- What audiences would you like to reach that you aren’t currently, or at least not as effectively as you would like?

- Under what assumptions is your organization currently operating? Where would you like to test your hypotheses against actual research?

With market research, it’s easy to accomplish too much or gather too much information that drowns out your goals. With clearly defined objectives, you’ll have guideposts to refer back to throughout the process and keep your team on track.

If you’re struggling to articulate your objectives, consider partnering with a nonprofit marketing consultant early in your market research process. This consultant can evaluate your nonprofit’s overarching goals and help you define the research objectives that will help you accomplish them. Beyond that, the consultant can help you carry out the rest of your market research process, continuing through the following steps.

Step 2: Define your nonprofit market research approach.

Once you’ve established your objectives, begin crafting your research strategy.

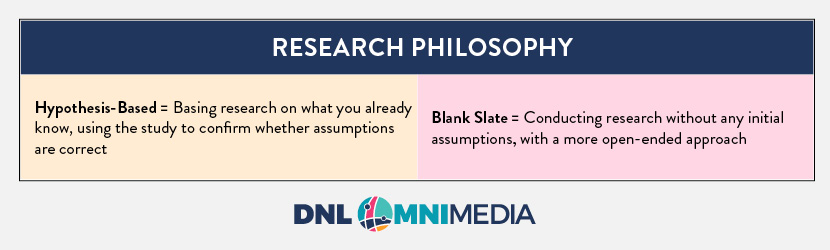

First, you’ll want to define your research approach, or the general philosophy that you’ll base your research strategy upon. There are two common research philosophies that you can choose between:

- Basing your research on a hypothesis. This involves starting your research using the information you already know about your supporters. You’d then draft research questions and strategies to test whether these assumptions are true. For example, if it seems like supporters respond well to social media, you would create survey questions asking supporters to confirm whether they like (or don’t like) your current social media strategy.

- Conducting research as a “blank slate.” This is the more objective of the two approaches and involves conducting research without any initial assumptions. You’ll build your research strategy around what information you want to learn and understand, with more open-ended questions to invite a wider range of responses.

Both are effective market research philosophies; the strategy you choose depends on your nonprofit’s unique research goals.

Step 3: Use available data to analyze your supporter base.

When looking to learn more about your donors, you’ll need to think outside the box. The data already available to your nonprofit concerning its donors and their engagement with your resources can help you identify relevant donor attributes and better target your research.

Here are a few key data sources to analyze.

Donor employer data

According to Adam Weinger, president of Double the Donation, the key to raising funds from corporate partners is in the hands of your most loyal donors. This means it’s your responsibility to analyze donor employer data and identify corporate philanthropic initiatives.

Knowing where your donors work may reveal matching gift fundraising opportunities. This allows you to market the opportunity directly to eligible donors and reveals key information about their giving capacities and motivations. Aside from determining their eligibility, employer data may also reveal:

- Giving capacities: While employer data won’t reveal donors’ salaries, you can use what you know about their job titles to estimate their income level. For example, an executive employee may be capable of increasing their gift size.

- Motivations: Let’s say one of your loyal donors works at a veterinarian’s office. This individual’s career choice might indicate their alignment with your nonprofit’s values or goals. In this case, your donor could be passionate about animal care, making them personally invested in an animal shelter’s mission to bring affordable vet services to pet owners.

- Other opportunities for support: Matching gifts isn’t the only opportunity for corporate support, and identifying donors’ employers can help your nonprofit pursue other corporate partnerships. For example, these for-profit organizations may be receptive to a corporate volunteer day or sponsorship.

Donor employer data empowers your nonprofit to not just engage supporters, but also its community by building relationships with local businesses.

Website data

Processing 8.5 billion searches per day, Google has an immense global reach. This makes it a valuable tool for educating and inspiring a wider audience, according to Michelle Hurtado, Global Head of Google Ad Grants.

Because your nonprofit’s website holds the power to bring awareness to your cause and urge donors to take action, the metrics associated with your website’s traffic can reveal what visitors are looking for when they land on one of your pages. By understanding why individuals visit your website, you can employ a more successful approach to engaging them online.

Evaluate key metrics, such as:

- Keywords: What are visitors searching for when they find your website? This offers insights into a donor’s motivations when searching for your website, which can help guide your research. Additionally, this data is invaluable when applying for and using the Google Ad Grant, which will ultimately help to grow your website audience.

- Bounce rate: Just because a visitor lands on your website doesn’t mean they spend quality time on each page. Evaluate bounce rate to determine how many visitors leave your site without interacting with multiple pages. This helps you narrow down which visitors are truly invested in your website’s content and what they’re looking for.

- Conversion rate: Identify site visitors who were inspired to take action. Conversions vary depending on your website’s content and goals. For example, site visitors may “convert” by submitting a web form or downloading educational content.

If your nonprofit uses the Google Ad Grant, you may track the program’s influence on your website through Google Analytics. An agency dedicated to managing the grant can track the progress of your campaigns for you. Then, you can incorporate the data they collect into your market research.

Historical campaign performance

Those who volunteer with your organization demonstrate an affinity for your cause—even if they don’t donate monetarily. This means these individuals are promising prospects to convert into donors.

Analyze your volunteer data to identify your longest-standing supporters and those who volunteer most frequently. You can offer other involvement opportunities to these supporters in your communications since they’re likely willing to support your cause in various capacities.

To ensure you’re working with accurate data, consider conducting an append before getting started. This involves correcting any outdated or incorrect information, as well as supplementing your existing database with more information. For example, a donor’s previous employer may not offer a matching gift program. However, your nonprofit needs to know if that donor moves to a new job so you can keep up with their matching gift eligibility.

Step 4: Design your market research survey.

Equipped with your research philosophy and existing data, you can begin actually designing your research survey.

Market research is built upon surveys in which you ask participants questions and record and analyze their responses. Designing these surveys includes making a number of decisions, including:

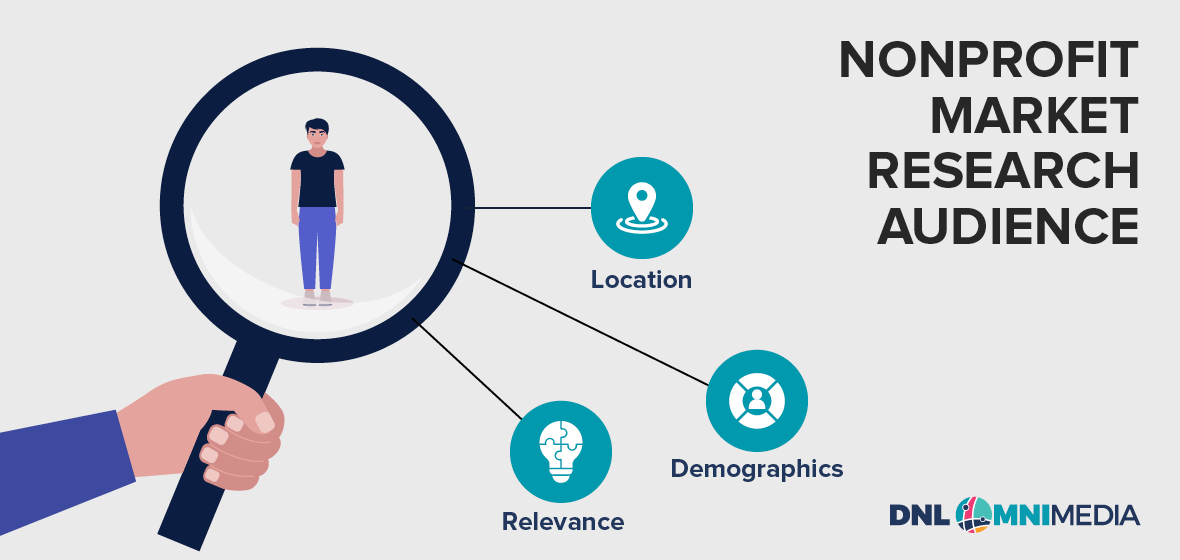

Defining Your Audience

Who do you need to talk to in order to gain the information you seek? This could be a certain segment of your supporters overall, such as advocates or volunteers, or you could get even more specific within a segment, such as first-time donors, recurring donors, or major donors.

Once you’ve generally defined the category of supporters to whom you’d like to speak, you’ll want to narrow your focus down further. There are several factors to consider, such as:

- Location. Technology now allows nonprofits to have supporters locally and around the world. Determine if you want to focus on supporters in a specific location, whether within a close proximity to your main operating location or perhaps around the country.

- Demographics. Are you seeking to learn about supporters that are a specific age or gender? Or perhaps those with a certain financial capacity to give?

- Relevance. Critically examine your audience against the specific research objectives you’ve set. Will this audience provide relevant information with regard to those objectives?

Aim to strike a balance that sufficiently narrows your audience so as to not get irrelevant data, but doesn’t narrow it so much that you receive too few responses. Ideally, aim to identify significantly more potential respondents than the minimum amount of responses needed to yield effective insights. That way, if people don’t respond, you’ll still have enough information to be statistically significant.

Designing Your Survey Method

Survey-driven research generally falls into two categories, and both will be useful for your organization’s efforts. The two categories are:

- Quantitative Research: This research yields numerical, measurable data that can be transformed into useful statistics. This data is used to collect general results from a large sample population, and it allows the researcher to spot patterns and form hypotheses for further exploration. One method that yields quantitative data is questionnaires, whether via telephone, on-site, or online.

- Qualitative Research: This research is used to gain an understanding of the underlying reasons, opinions, and motivations behind quantitative data. It’s used for understanding the “why” behind the statistics and is accomplished through asking open-ended questions. Common methods that generate qualitative data include focus groups, interviews, and participant observation.

You’ll likely want to use a combination of the two research types in your overall market research method.

For example, you could send out written questionnaires to a large number of supporters within your target audience (quantitative) and then interview a handful to understand why they answered the way they did (qualitative). Or, you could do the reverse and interview some supporters to gain a general understanding of their thoughts (qualitative) and then use a questionnaire to confirm that the rest of your audience does or doesn’t feel the same way (quantitative).

Authoring Your Research Questions

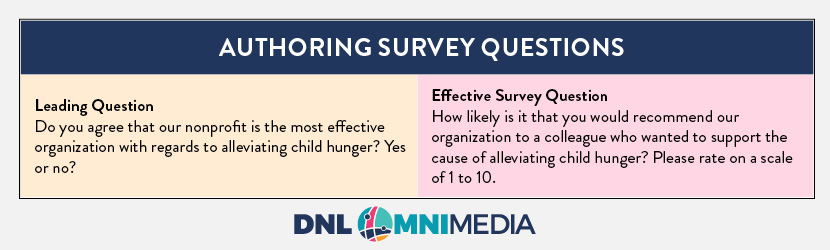

Regardless of whether you’re using qualitative, quantitative, or a combination of both research methods, your market research will be based on asking questions. So, the final step in designing your market research survey is to author those questions.

Consider the objectives you created at the beginning of your research journey. All questions should track back to those goals. For all questions, ask yourself if the information is actually important for reaching your objectives.

Further, pay attention to the way you word questions and queries. The goal is to avoid leading questions, as those could trigger skewed or unreliable responses. Consider the following example:

Do you agree that our nonprofit is the most effective local organization, with regards to alleviating child hunger in our region? Yes or No?

This is an example of a leading question. Because phrases such as “Do you agree” and “the most effective” are included in the question, the reader may be swayed to respond positively regardless of what they truly believe.

How likely is it that you would recommend donating to our nonprofit to a friend or colleague? Please rate on a 1 – 10 scale, with 1 being unlikely and 10 being highly likely.

This is an example of an effective market research survey question. It encourages respondents to provide their honest opinion, without including language that would sway the respondent to answer in any particular manner.

While authoring neutral questions is crucial for the success of your market research survey, it’s not necessarily an intuitive process — especially for nonprofit professionals who are truly invested and believe in their organization’s work. This is another area where it can be helpful to work with a nonprofit consultant, as this partner can bring an unbiased perspective that can help your team write effective survey questions.

Step 5: Pre-test survey questions.

You carefully selected audience members for your survey, and you only have one chance to successfully conduct market research with that audience. If you share an ineffective survey with that audience, you can’t simply amend the survey and re-share it— the audience members will be biased by their previous survey experience.

Because of this, it’s important to pre-test your survey questions before deploying them to your entire audience. The easiest way to do this is to share your survey with a small group of your nonprofit’s supporters, whether they’re within your original audience or not. Ask them to complete the market research process and provide feedback on any questions or steps in the process that confused them. Then, adjust your questions and deploy your survey to your full audience!

Step 6: Execute your market research.

Now, it’s time to execute your research. This could mean sending out a questionnaire, interviewing participants on-site, or even conducting focus groups, depending on the strategies you chose earlier in the planning process.

When executing your research, there are a few key tips to keep in mind:

- Incentivize supporters to participate. For example, you could set a cut-off date for participation to add some urgency. Or, you could invite survey participants to have first-look access to register for an exciting upcoming event.

- Keep the survey open until you receive enough responses. The goal is to ensure your data is statistically significant, or that you receive enough responses to reasonably extrapolate findings to a larger population.

And lastly, make sure you have a plan in place for storing and managing this new data in an organized manner. Most likely, you’ll want to store it in your CRM, which will allow you to examine it in the context of all of the other information you have on your supporters.

Once you receive enough responses, go ahead and close the survey. But, your work isn’t done yet! Now, it’s time to analyze your data and outline a few next steps.

Step 7: Analyze your data and create a plan of action.

Begin combing through your data and analyzing it.

This is where, if you went with a hypothesis-driven approach, you would examine the data against your hypothesis. Or, if you went in with a “blind” approach, you’d look for patterns more generally.

These “patterns” are called insights, which you can then take action on to improve your organization’s processes.

Consider the following examples:

Your audience says they would prefer to be communicated with via text message instead of the emails you currently send.

Action: Set up a service that allows you to send text updates to your audience moving forward, and reconsider how to utilize email marketing in a way that better resonates.

When asked to define your nonprofit’s mission, your audience gives an answer that is contradictory to what your nonprofit wants to convey.

Action: Create a document that clearly defines the message and positioning of your nonprofit and consult it when creating all communications.

Board members are frustrated with your nonprofit’s lack of a larger presence in the community, and it’s causing them to lose interest instead of being the strong organizational advocates you need them to be.

Action: Create a strategy focused on community engagement, positive image-building, and relationship management.

When analyzing responses, look at your data from multiple angles. Do your insights change when you look at regional responses? How about when you filter responses by age, gender, or income level? This comprehensive review will ensure your insights are well-informed and not overlooking anything.

Wrapping Up

After six months of implementing the actionable strategies you created, revisit your initial research findings. Have things changed since you laid out your initial next steps? You may need to adjust strategies based on a new organizational objective or shift in priorities.

Additionally, measure the effectiveness of the strategies implemented. What’s working well, and what could be improved? Continue to test and refine based on the results you see and do this throughout the life cycle of your nonprofit.

For help bringing your market research strategy to life, connect with Team DNL today. In the meantime, review the following additional resources:

- Nonprofit Marketing Consulting: Overview & 6 Top Picks. A nonprofit marketing consultant can help your team navigate the research process. Explore this type of consulting services in this guide.

- Nonprofit Consulting Firms: 26 Leaders in Their Spaces. Nonprofit consulting spans far beyond marketing. Explore the wide range of nonprofit consulting services here.

- Creating a Nonprofit Digital Strategy: 7 Steps for Success. Technology is a valuable tool when conducting market research. Learn about the many tools available to your nonprofit in this guide.